Digital Tax Stamps Enhancing Standards of Products

The Ugandan government has reaffirmed its commitment to leveraging digital innovations to bolster tax compliance, with digital tax stamps emerging as a cornerstone of this effort.

Digital tax stamps are secure labels affixed to excisable goods.

The Ugandan government has reinforced its commitment to using digital innovations to strengthen tax compliance, with digital tax stamps becoming a key component of this strategy.

Introduced in November 2019, digital tax stamps have played a critical role in enhancing transparency, combatting tax evasion, and ensuring the authenticity of goods on the market.

Digital tax stamps are secure labels affixed to excisable goods such as beverages, tobacco, and cement.

They feature encrypted codes that can be scanned to verify the authenticity and tax compliance of a product, allowing both the Uganda Revenue Authority (URA) and consumers to track goods throughout the supply chain.

The stamps were implemented in partnership with SICPA a global leader in secure tax stamp technologies to address tax evasion and counterfeiting while promoting fair competition in Uganda’s marketplace.

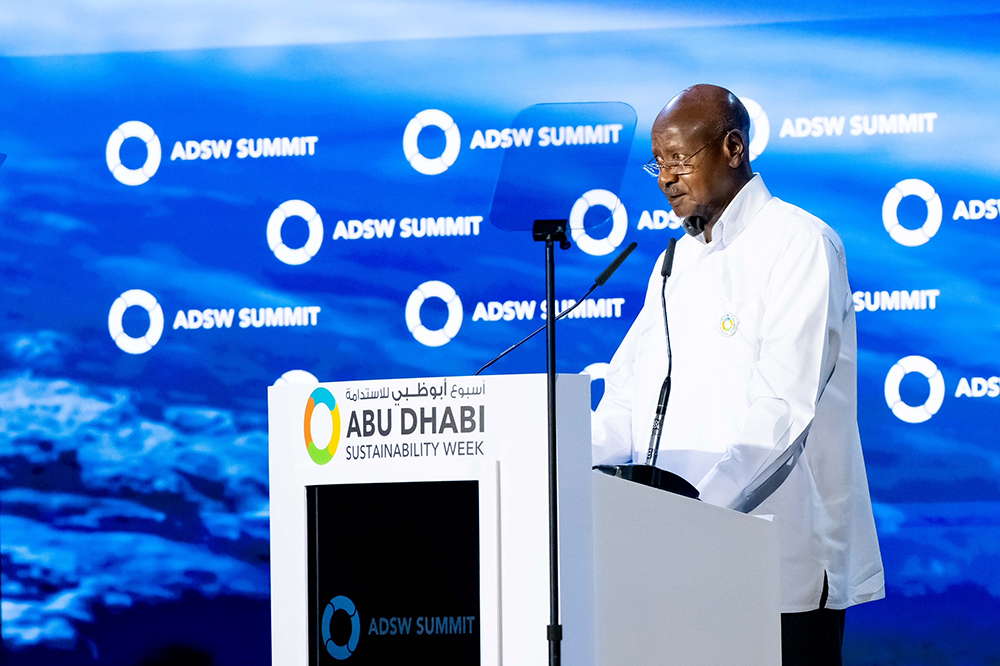

Speaking at the URA Taxpayers’ Appreciation Day 2024 under the theme ‘honouring pillars for national growth’ finance minister Matia Kasaija emphasized that taxes are not merely financial obligations but essential investments in Uganda’s collective future.

He lauded taxpayers for their resilience and contributions to national growth.

“Taxes fund the education of our children, ensure quality healthcare for our communities, and build infrastructure that connects people, businesses, and opportunities.”

The digital tax stamp system is seen as aligning with this vision, reinforcing trust in Uganda’s tax administration.

By enabling real-time monitoring of tax compliance, the stamps are reducing illicit trade and counterfeit products actions that protect consumers and ensure equitable tax contributions.

Minister Kasaija described tax compliance as a patriotic act, urging businesses to embrace the digital tax stamps initiative as part of their commitment to national development.

Finance minister Matia Kasaija

“Complying with tax obligations demonstrates trust in the system and a collective responsibility to uplift Uganda from past economic challenges, including the COVID-19 pandemic,” he said.

At the event of appreciating taxpayers, URA commissioner general John Rujoki Musinguzi spoke about the significant role of URA in the collection of taxes, emphasizing the expanded tax base and improved revenue collection.

He highlighted the efforts made by the national tax body to ensure compliance across industries, which has fostered fairness and accountability within Uganda’s tax system.

Uganda’s economy is projected to grow by 6% this financial year (2024/2025), driven by advancements in agriculture, manufacturing, and services.

Kasaija attributed this progress, in part, to the increasing adoption of technology in governance, including digital initiatives such as the digital tax stamps.

As Uganda strengthens its global market access and pursues its ambitious economic goals, digital tax stamps remain a key tool in achieving sustainable growth and ensuring equitable contributions from all sectors.

With ongoing government efforts to engage businesses and the public, the initiative is expected to continue its crucial role in shaping Uganda’s tax regime and supporting the national development agenda.