Absa Bank Uganda Introduces Absa Mobi Tap: Advancing Digital Payments for Businesses

Absa Bank Uganda’s new payment system called Absa Mobi Tap, allows customers to use their debit or credit cards on Android smartphones or tablets for making payments. The technology aims to promote a cashless economy and enhance the financial inclusion of small businesses by providing them with a transparent digital record of transactions. It also reduces operating costs for businesses while improving the customer experience. Absa’s executives believe that this innovation will play a crucial role in the nation’s digital economy.

Customers of Absa can tap their debit or credit cards on their Android smartphones or tablets to make payments using the payment system known as Absa Mobi Tap.

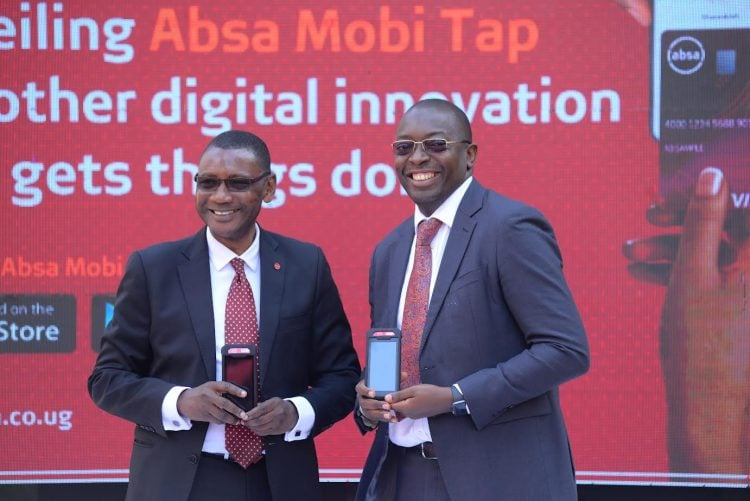

“Technology is raising the bar for us. Imagine having a phone that could take money from your store! Since you can do all your transactions on your phone or other tiny device and we are creating a cashless economy, the bullion van industry is evolving,” according to Michael Segwaya, Executive Director and Chief Finance Officer of Absa Bank Uganda, who spoke at the inaugural event at National Theatre.

The majority of MSMEs are informal and unbanked, which makes it difficult for them to obtain credit or draw in investors. This is one of the barriers to their growth. With this innovation, we are giving small businesses the option to keep a transparent digital record of their transactions, which will greatly aid them in managing their finances and proving their viability to potential funders.

Musa Jallow, Director of Retail Banking at Absa Bank Uganda, claims that the advancement is a key factor in the nation’s digital economy.

“Smartphones have fundamentally altered how we think about mobile phones. We use it for more than just making phone calls. Millions of people’s lives are being transformed by the mobile phone, not just in Uganda but all around the world.”

According to Jallow, the Absa Mobi Tap turns a standard smartphone or tablet into a safe digital payment terminal without the need for additional hardware.

“This automatically reduces operating costs for the company owner while maintaining a flawless customer experience. By assisting them in managing their finances, we are integrating small and medium-sized businesses into the financial system and promoting their formalization.”