NSSF savers to get 10% interest on savings for the financial year 2022/2023

The National Social Security Fund (NSSF) announced a 10% interest payment for savers in the 2022/23 financial year and its remarkable growth and financial performance, with assets reaching sh18.56 trillion.

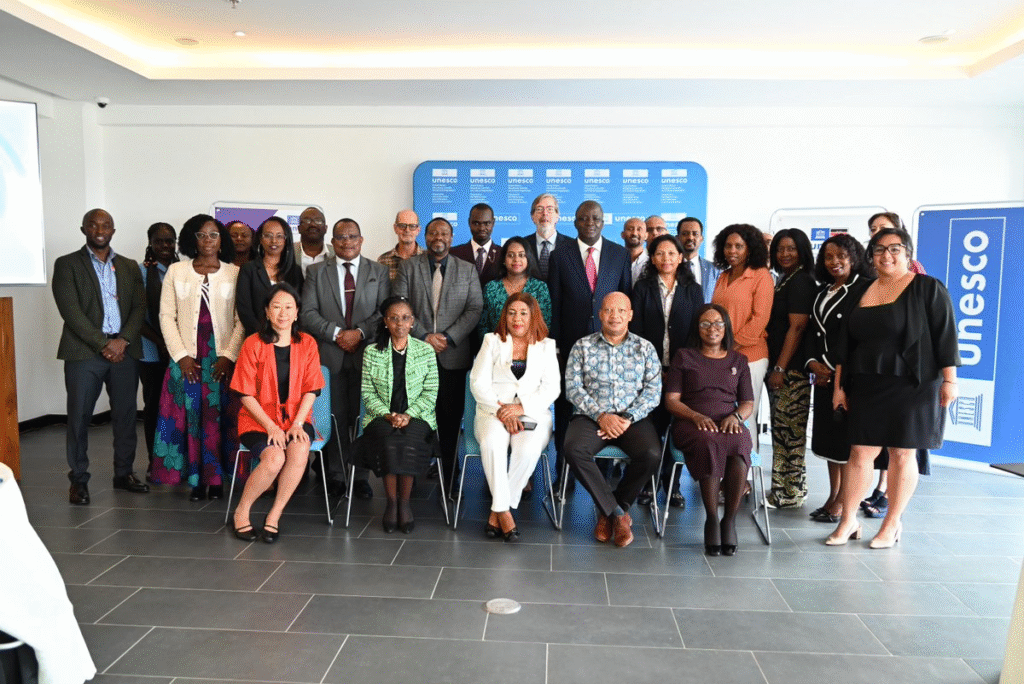

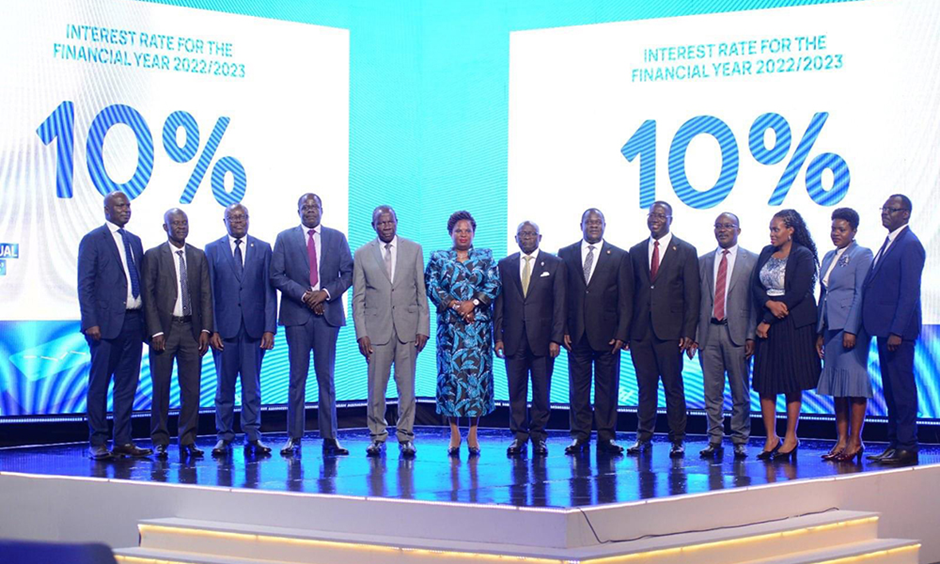

The Shareholders of the National Social Security Fund (NSSF) have reason to rejoice, as it was announced on Tuesday 26th September 2023 that a 10% interest payment will be granted to savers for the financial year 2022/23. This significant revelation transpired during the 11th annual meeting for members held at the prestigious Kampala Serena Hotel.

During the announcement of this new interest rate, the Honourable Finance Minister, Matia Kasaija, commended NSSF for its outstanding performance across various key performance indicators. He noted that the fund’s assets experienced substantial growth, increasing from sh17.8 trillion in the financial year 2021/22 to sh18.56 trillion in 2022/23, marking a noteworthy milestone.

Furthermore, Minister Kasaija highlighted another pivotal performance indicator the substantial increase in total realized income, which surged by 15%, rising from sh1.9 trillion in the financial year 2022 to sh2 trillion in the financial year 2022/23. He attributed this achievement to the prudent investment decisions made by the fund managers throughout the year 2022/23.

The Minister of Labour, Betty Amongi, whose responsibilities encompass NSSF, underscored the significance of the fund’s growth to sh18 trillion. She emphasized that the majority of NSSF members are individuals with modest incomes, describing them as the most vulnerable segment of the population.

Notably, 83% of savers hold savings below sh10 million, while those earning an average income of sh250,000 per month constitute a significant portion. Additionally, savers with balances ranging from sh10 million to sh50 million account for 12%, whereas those with savings between sh50 million and sh100 million represent only 3% of the savers.