Uganda’s Coffee Industry Nears $1B Milestone

In a noteworthy development, Uganda’s coffee export earnings have edged closer to the $1 billion mark in 2023, driven by increased production volumes, improved coffee prices, and heightened competition among foreign buyers According to the latest data from the Uganda Coffee Development Authority (UCDA)

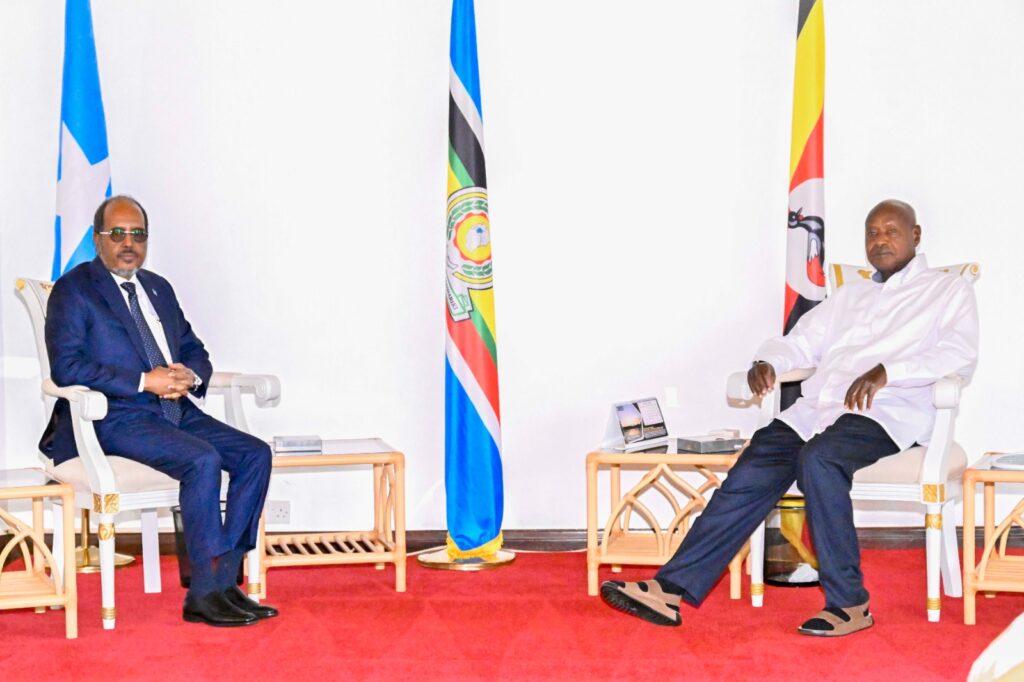

Courtesy Photo

Due to higher production quantities, higher coffee prices, and more competition from outside customers, Uganda’s coffee export revenues have significantly increased and are expected to approach $1 billion in 2023. As to the most recent data available, the Uganda Coffee Development Authority (UCDA)

According to the latest data from the Uganda Coffee Development Authority (UCDA), total coffee export revenues surged from $883.3 million (November 2021-October 2022) to $952.24 million (November 2022-October 2023).

Concurrently, total coffee production witnessed an uptick from 5.83 million to 6.16 million 60-kilogram bags during the same period.

Robusta coffee maintained its dominance, constituting over 70 percent of Uganda’s total coffee output. The surge in local coffee prices during the latter half of 2023, particularly for Robusta Kiboko and Fair Average Quality Robusta, reflects rising global demand and positive quality assessments of the country’s coffee crop.

The UCDA report highlights a slight decline in the market share of the top 10 buyers, dropping from 71 percent to 67 percent. Louis Dreyfus led the pack with a 13.93 percent market share, a significant increase from 8.93 percent in September 2023. Sucafina, Volcafe, Olam International, and Bernhard Rothfos followed closely.

Italy emerged as the largest consumer of Ugandan coffee, commanding a 28.95 percent share, with Germany, Spain, India, and Algeria also contributing significantly. However, the dynamics of the market, including erratic supply patterns, climate change, and increased domestic coffee consumption in some producer countries, influenced higher coffee prices in the latter half of 2023.

Looking ahead, industry experts such as Robert Byaruhanga, Managing Director at Funzo Coffee Ltd, anticipate stable export revenues for Uganda in the coming year due to reasonable demand patterns internationally.

Uganda coffee was ranked 3rd best in the world behind Ethiopia and Kenya by professional coffee tasters in a survey of the top 16 coffee-growing countries in the world.

The coffee tasters graded 1,229 coffees from around the world that was harvested from 2010 to 2018 with the top three spots going to African countries.

The professional coffee tasters are certified by the Coffee Quality Institute (CQI), a non-profit organization that works internationally to improve the quality of coffee and the lives of the people who produce it.

Additionally, the influx of new entrants into the parchment business is expected to further drive-up coffee prices.

Kyagalanyi Coffee Ltd secured the top spot as Uganda’s largest coffee exporter with a 16.39 percent market share by the end of October 2023, followed closely by Louis Dreyfus Company Uganda Ltd. Other leading exporters include Ugacof Uganda Ltd, Ideal Quality Commodities Ltd, and Olam Uganda Ltd.

While acknowledging the role of government programs in supporting new coffee farmers, challenges such as seed varieties and planting techniques have been noted by industry insiders. Despite these challenges, coffee remains a cornerstone of Uganda’s agricultural economy, as emphasized by Uganda Coffee development Authority.